Your credit score is more than just a number—it’s a financial reflection of your reliability and trustworthiness. From renting an apartment to securing a mortgage or car loan, your score can impact nearly every major decision involving money. For residents of New Jersey, understanding the process of credit repair in NJ can be the key to gaining financial stability and independence. With rising costs and increasing credit usage, knowing how to rebuild credit the right way isn’t just helpful—it’s essential for long-term financial health.

What Is Credit Repair and Why Does It Matter?

Understanding the Purpose of Credit Repair

Credit repair involves identifying and correcting inaccuracies on your credit report, improving your payment habits, and managing debt responsibly. Many individuals are unaware that a single reporting error—like a wrongly marked late payment or outdated account—can significantly lower their credit score. Effective credit repair in NJ ensures that your report accurately represents your financial behavior, giving you access to better interest rates and lending opportunities.

The Legal Framework for Credit Repair in New Jersey

Credit repair is governed by the federal Fair Credit Reporting Act (FCRA), which gives consumers the right to dispute errors and request corrections from credit bureaus. Additionally, the Credit Repair Organizations Act (CROA) protects consumers from unethical practices by ensuring transparency and honesty from agencies offering these services. In New Jersey, several certified agencies adhere to these regulations, providing safe, legitimate ways to help residents regain financial control.

How to Start the Credit Repair Process

Step 1: Obtain and Review Your Credit Reports

The first step in effective credit repair in NJ is to access your credit reports from the three major bureaus—Experian, Equifax, and TransUnion. Every individual is entitled to one free report per year through AnnualCreditReport.com. Carefully reviewing these documents can reveal issues like duplicate accounts, incorrect balances, or unfamiliar credit inquiries. Addressing these inaccuracies promptly can make a noticeable difference in your credit score.

Step 2: Dispute Errors with Proper Documentation

If you identify any incorrect entries, file a formal dispute with the respective credit bureau. The process typically involves submitting written documentation, such as account statements or payment confirmations, to support your claim. Once the bureau receives your dispute, they are legally required to investigate and respond within 30 days. Successful disputes can lead to deletions or corrections that immediately improve your credit score.

Step 3: Establish Better Financial Habits

After clearing up inaccuracies, the next phase involves improving your personal credit habits. This includes making payments on time, reducing credit card utilization below 30%, and avoiding unnecessary credit applications. Creating a monthly budget and using automated bill payments can help maintain consistency and prevent late fees. Over time, these habits can rebuild trust with lenders and strengthen your financial profile.

What Role Do Professional Credit Repair Agencies Play?

Expertise and Negotiation Power

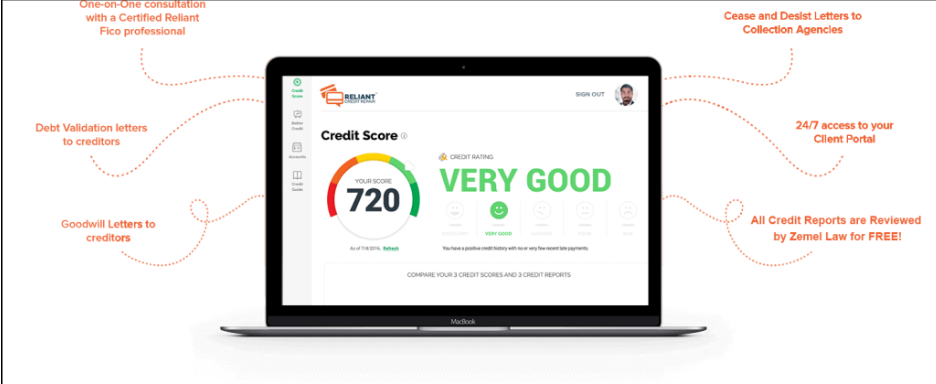

While individuals can repair their credit independently, working with professionals can expedite the process. Agencies that specialize in credit repair in NJ have the tools and expertise to communicate directly with credit bureaus and creditors. They often use advanced software to track disputes, negotiate with lenders, and ensure every step is compliant with regulations.

Customized Strategies for Financial Recovery

Professional agencies provide personalized guidance tailored to each client’s financial situation. They assess your debt-to-income ratio, payment history, and credit usage to develop a structured recovery plan. Many also educate clients on building long-term credit strength—covering topics like responsible credit card use, loan management, and debt consolidation. This individualized attention ensures that your efforts lead to sustainable financial improvement rather than temporary fixes.

Conclusion

Rebuilding your credit doesn’t happen overnight—it takes patience, persistence, and the right approach. Partnering with experts who specialize in credit repair can help you navigate complex credit systems and achieve measurable results faster. Whether you’re aiming to qualify for a mortgage or simply reduce debt stress, professional repair credit services provide the structure and guidance you need to take control of your financial future with confidence.