Introduction

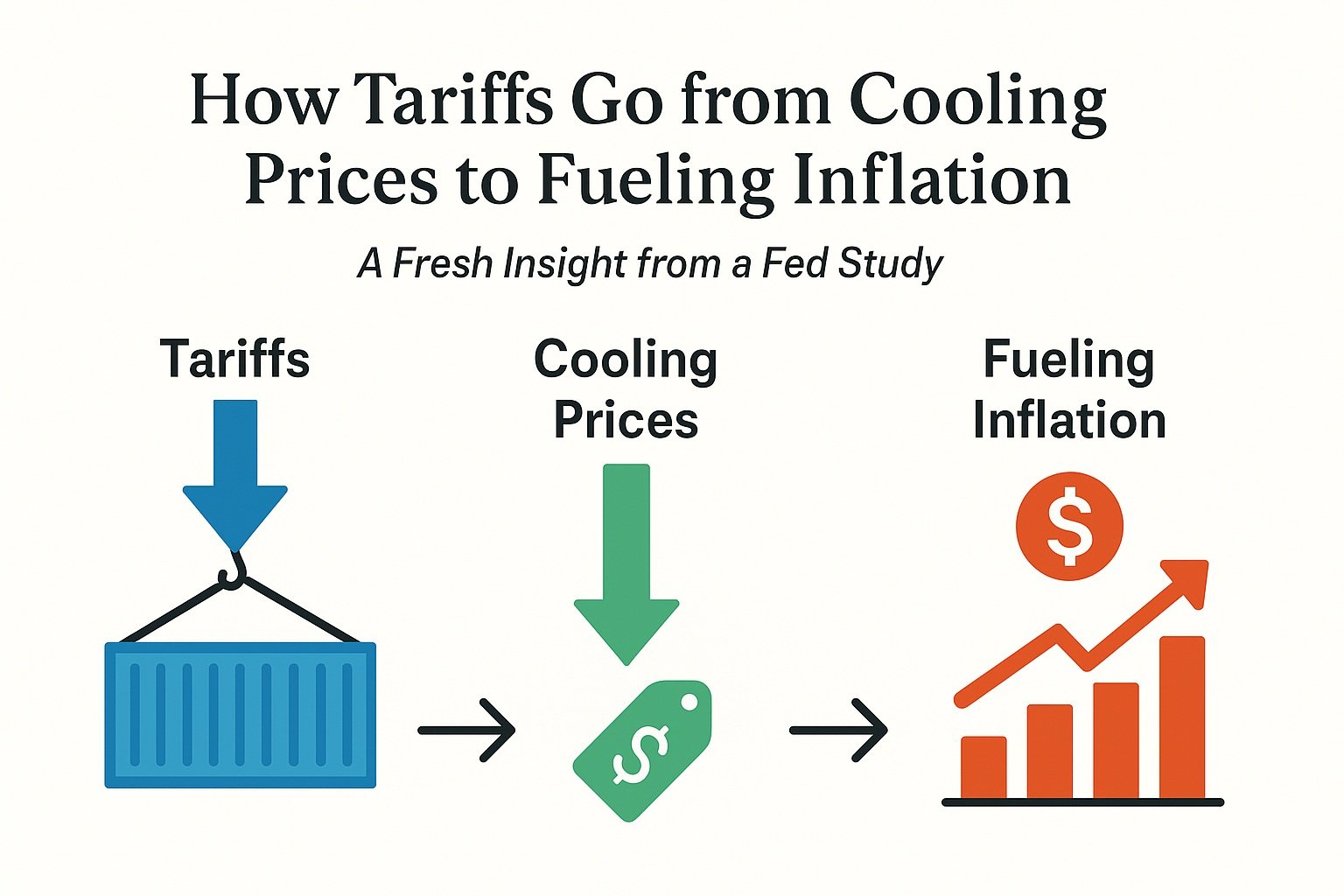

A new analysis from the Federal Reserve Bank of San Francisco reveals something unexpected about tariffs: they can lower inflation in the short term, but over time they may actually push inflation higher than if tariffs had never been introduced. For businesses, importers and policymakers, understanding this two-phase effect is essential for making informed decisions in a rapidly shifting global trade environment.

Short-Term Effect: Tariffs Create a Demand Shock That Lowers Inflation

Research covering several decades of global economic data shows that inflation tends to fall immediately after a tariff increase.

Here’s why:

- Tariffs make imported goods more expensive.

- Higher prices discourage consumer and business spending.

- Reduced spending weakens overall demand in the economy.

- This creates a “negative demand shock,” which temporarily pulls inflation down.

During this initial slowdown, unemployment may also increase as economic activity cools. This phase gives the appearance that tariffs are helping control inflation — but the effect is short-lived.

Long-Term Effect: Supply Disruptions Push Inflation Higher

As the economy adjusts, the early cooling effect fades. Economic activity recovers, and inflation begins to rise again often to a higher level than it would have reached without the tariff increase.

This happens because:

- Tariffs disrupt global supply chains.

- Import-dependent businesses face higher costs for raw materials and components.

- Production becomes less efficient.

- Supply shortages develop, pushing up prices across industries.

Studies estimate that a significant tariff increase can eventually raise inflation by around 1 percentage point after the initial dip. This long-term inflation is driven by supply constraints rather than demand changes.

What This Means for Businesses and the Economy

For importers and textile companies

Initial tariff hikes may seem manageable due to lower demand and reduced inflationary pressure. But as time passes, rising costs for imported materials can squeeze profit margins and force companies to increase retail prices.

For manufacturers shifting to domestic sourcing

Domestic suppliers may see more demand, but many are not prepared to ramp up production quickly. This can lead to capacity gaps and rising local prices, contributing to long-term inflation.

For policymakers and economic strategists

Tariff timing and scale are crucial. While tariff increases may temporarily cool inflation, the delayed surge in supply-driven inflation may require policy adjustments to stabilize the economy.

Why These Findings Need Careful Interpretation

The economic environment today is not the same as in past decades. Recent U.S. tariff hikes have been unusually large, and external factors — such as supply-chain instability, geopolitical tensions, and commodity price volatility — can influence how tariffs affect inflation.

Because the inflation shift depends heavily on how businesses and consumers adapt, the long-term effect of tariffs is not always predictable.

Conclusion

Tariffs are more complex than they appear. While they may provide short-term relief by slowing demand and cooling prices, their long-term impact can lead to higher inflation, strained supply chains, and increased business costs.

For companies in sectors like textiles, manufacturing, retail, and import-dependent industries, the takeaway is clear: tariff changes must be monitored closely, and strategies like diversified sourcing, cost planning, and supply-chain resilience are essential to stay competitive in a high-risk trade environment.

For More Info Visit:- marketingbiznews.com